After a continued sluggish interval, the commercial 3D printer market noticed indicators of development within the third quarter of 2025, due to demand for additive manufacturing (AM) methods from customers in aerospace and defence, and the home market in China.

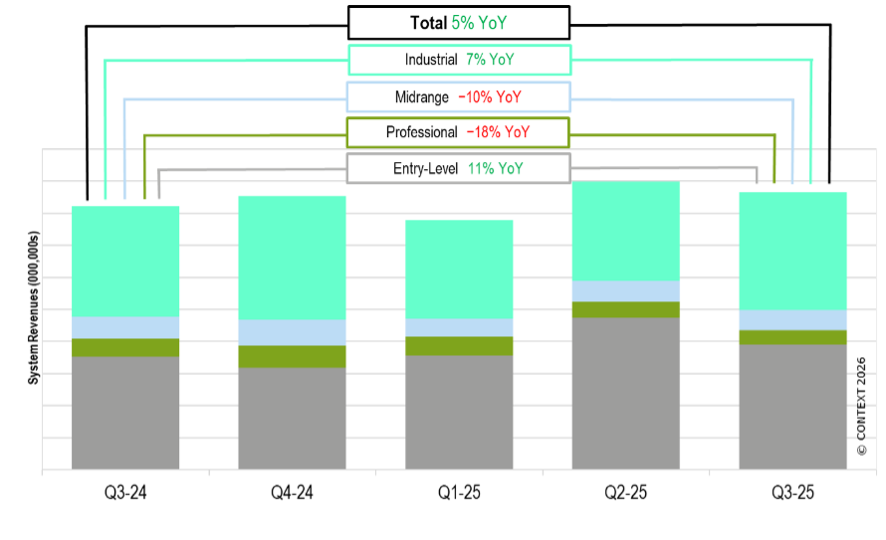

In response to new figures from market intelligence firm CONTEXT, total 3D printing {hardware} revenues rose 5% YoY in Q3 2025 with robust shipments of entry-level 3D printers and development in steel AM platform gross sales.

“The temper throughout the excessive finish of the market remains to be cautious, however it’s not defensive,” stated Chris Connery, Vice President of World Evaluation at CONTEXT. “The business has moved previous the expansion-at-any-cost section and is now concentrating on sectors the place additive manufacturing is already delivering clear financial worth. Aerospace, defence and home Chinese language manufacturing are doing many of the heavy lifting.”

Shipments of methods priced above $100,000 rose 3% YoY in unit phrases. The strongest gross sales got here from China, the place shipments had been up 22% owed to important figures from home OEMs together with ZRapid Tech and BLT.

The restoration got here primarily from gross sales of steel Powder Mattress Fusion (PBF) methods, which elevated by 25% YoY, whereas polymer platforms in the identical class continued to wrestle. Chinese language steel PBF distributors noticed shipments rise 35% YoY, with most methods remaining inside the native market with home prospects primarily working in aerospace and personal area.

Western aerospace and defence prospects additionally confirmed renewed shopping for exercise, although much less substantial. EOS delivered a robust quarter with revenues up 20% YoY, whereas Nikon SLM Options maintained its place in large-format steel methods as a result of continued success of its NXG platform.

For mid-range machines priced between $20,000 and $100,000, shipments fell -13% YoY. Throughout industrial and midrange worth lessons mixed, unit cargo leaders included UnionTech, Stratasys, ZRapid Tech, Formlabs, 3D Programs, Flashforge, HP, Nano Dimension (together with Markforged), EOS and BLT. Notable optimistic year-on-year cargo development was recorded by UnionTech, ZRapid Tech, BLT, EOS and HP.

The skilled worth band, masking methods priced between $2,500 and $20,000, additionally confronted a decline by -14% YoY, pushed nearly totally by falling demand for materials extrusion methods as consumers opted for considerably lower-priced entry-level machines. Nonetheless, vat photopolymerisation methods remained resilient, with Formlabs taking roughly a 40% share of the market.

Success, nevertheless, continued within the sub-$2,500 entry-level market with world shipments rising by 18% YoY. The optimistic figures on this class are as soon as once more being pushed by distributors in China with desktop firms Bambu Lab and Creality accounting for 57% of worldwide shipments through the quarter.