6K Additive has commenced buying and selling on the Australian Securities Trade beneath the ticker image 6KA.

Round 48m AUD has been raised with 6K Additive shares made obtainable at 1 AUD per share. The information comes every week after the corporate secured a 27.4m USD financing bundle from the Export-Import Financial institution of america (EXIM).

As with these funds, 6K Additive will leverage the capital raised by means of its Preliminary Public Providing (IPO) to gas the expansion of its manufacturing capability, in addition to increase its amenities. The corporate is aiming to extend capability from round 200 metric tons per 12 months to 1,000 metric tons per 12 months.

This ramp-up is available in response to the ‘rising wants of 6K Additive prospects’ within the aerospace, defence, power and industrial sectors. At the moment, 6K says its gross sales pipeline has expanded to 240m USD as of the tip of November 2025, marking a 10m USD improve prior to now two months. 6K expects market demand for its merchandise to develop considerably within the subsequent 3-5 years, with its refractory, titanium and nickel powders of explicit curiosity to prospects.

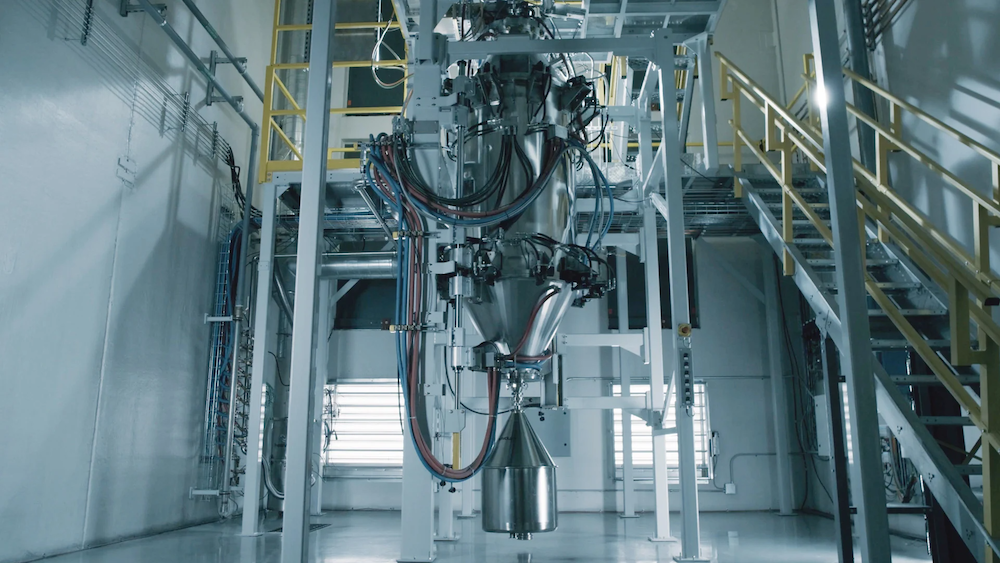

In accordance with 6K Additive, the enlargement plan for its Burgettstown facility, together with the addition of ingot soften functionality, is absolutely funded. The corporate may now put money into extra UniMelt plasma techniques, downstream processing gear, and pursue progress alternatives with key shoppers within the aforementioned markets. Moreover, final week’s fundraising is claimed to offer ‘flexibility for extra progress initiatives past the present enlargement plan.’

As 6K Additive listed on the ASX, CEO Frank Roberts, CFO Jonathan Wolak, and Chairman David Seldin rang the opening bell in Sydney.

“The IPO and ensuing capital fast-track the realisation of our imaginative and prescient and obtain the size with engaging unit economics and distinctive materials breadth required by prospects in defence, aerospace, power, and medical markets,” stated Roberts. “As a strategic provider to the U.S. Division of Battle and its Tier-1 contractors, our merchandise, manufacturing processes, and know-how have been certified of their provide chains, reinforcing these relationships. This progress allows a home provide of essential supplies for purposes reminiscent of hypersonics, nuclear fusion, medical implants, and rocket-engine improvement.”

David Seldin, 6K Additive Chairman of the Board and Managing Accomplice of Anzu Companions, added: “As an institutional investor in 6K Additive from its inception, I witnessed this organisation develop to the main home supplier of metallic powders and alloy additions. The breadth and high quality of 6K Additive’s merchandise, the trusted relationship with the US Division of Battle and the devoted worker expertise, underscore the potential this organisation has within the coming 3-5 years.”

On the Supply Value, 6K Additive has an preliminary market capitalisation of roughly 267m AUD and an enterprise worth of roughly 206m AUD. 6K says the IPO attracted robust assist from a variety of latest institutional, household workplace and complicated traders in Australia and abroad, along with present shareholders.