Regulators not settle for the excuse, “the seller made us do it.” If a cloud host crashes or a funds companion is breached, your fintech nonetheless owns the result: fines, escalations, offended prospects, and churn.

A 2024 business survey discovered that 61 p.c of firms suffered a third-party breach final 12 months, but 60 p.c nonetheless monitor vendor knowledge in spreadsheets—figures reported in a 2024 Safety Survey. That hole is an open invitation to attackers and a shiny warning gentle for examiners.

Luckily, a brand new technology of vendor-risk administration (VRM) platforms does the grunt give you the results you want. These instruments pull safety proof in actual time, map it to PCI DSS and SOC 2 controls, and floor points earlier than they grow to be headlines. For lean fintech groups, the fitting platform can save lots of of hours and make audit week really feel like every other Tuesday.

On this information, we overview six VRM options vetted for steady monitoring, fintech-specific compliance protection, and confirmed buyer outcomes, all in language that stays crisp and actionable.

Prepared to exchange that danger spreadsheet with software program constructed for the job? Learn on.

How we picked the six platforms

You deserve a shortlist you’ll be able to belief, so we began with a discipline of greater than 40 VRM instruments throughout banking, SaaS, and healthcare. Then we narrowed it all the way down to what truly issues for fintech.

First, we screened for regulatory alignment. Every platform needed to map controls to PCI DSS, SOC 2, FFIEC, DORA, and GDPR. No match, no place on the checklist.

Second, we required steady monitoring. Annual questionnaires aren’t sufficient when distributors ship modifications day by day, so we prioritized instruments constructed to floor new danger indicators as they emerge.

Third, we appeared for proof of influence. Public case research, verified person critiques, and impartial analyst notes counted. Advertising claims alone didn’t.

After these gates, we pressure-tested the sensible match utilizing fintech-focused tie-breakers: how a lot proof assortment is automated, whether or not the platform helps AI-assisted overview, how effectively it reuses vendor proof by means of exchanges or belief facilities, how cleanly it integrates into methods like Jira, Slack, and ServiceNow, and the way shortly a group can get to actual time-to-value with out including course of bloat. Vanta’s Vendor Danger Administration (VRM) implementation information describes a best-practice workflow that makes use of an inherent danger rubric, scheduled safety overview cadences, auto-requested proof 30 days earlier than a overview is due, and AI reply extraction from vendor paperwork to maintain groups targeted on actual findings. We appeared for platforms that delivered comparable mechanics out of the field so fintech danger groups can spend extra time on choices and fewer time wiring collectively spreadsheets, e-mail reminders, and handbook doc critiques.

The result’s six platforms that pair compliance protection with dwell danger indicators and a transparent monitor report of outcomes.

1. Vanta: unified compliance meets dwell vendor oversight

Vanta is finest identified for serving to groups get to SOC 2 shortly. That very same automation basis now extends into their TPRM automation software program, automating questionnaires, reusing shared proof, and repeatedly monitoring suppliers—an strategy Vanta supplies say can reduce overview effort by greater than 50 p.c for lean fintech groups.

Vanta is right for:

- Rising fintechs that want one system for inner compliance and third-party oversight

- Groups managing a big SaaS and API vendor footprint with restricted danger headcount

- Organizations balancing PCI DSS and SOC 2 necessities with privateness and operational resilience expectations

On the core, Vanta provides you a vendor stock, inherent and residual danger scoring, configurable questionnaires, and a vendor portal for proof assortment. It additionally helps shadow IT discovery and ties remediation work into the instruments engineering groups already use, so vendor danger doesn’t dwell in a separate spreadsheet or a separate platform.

The place Vanta stands out for fintech patrons is steady monitoring. Along with evaluation workflows, Vanta VRM with Monitoring provides first-party exterior indicators comparable to breaches, leaked credentials, misconfigurations, and vulnerability-related findings, with alerting that may be tuned by vendor criticality. Inside supplies describe protection throughout roughly 2,000 massive distributors and 12+ cyber discovering varieties as of Oct 17, 2025. In case your program already makes use of third-party rankings suppliers comparable to SecurityScorecard or BitSight, Vanta can ingest these indicators so as to add context.

On the compliance facet, Vanta maps controls throughout 35–40+ frameworks (inner supplies present 35+ built-in frameworks and 40+ as of Jan 2026), together with cross-mapping that helps danger groups translate vendor proof into auditor-friendly language for requirements like SOC 2, PCI DSS, and GDPR. For U.S. financial-services groups, Vanta prospects additionally align critiques to the 2023 interagency third-party steerage. For EU packages, groups use scheduled critiques, inherent and residual danger, and monitoring to assist DORA-oriented oversight.

Vanta additionally leans laborious into automation and AI. Vanta AI can scan vendor SOC reviews, ISO certificates, DPAs, and insurance policies to assist auto-answer your templates and summarize gaps with citations, then monitor remediation by means of linked duties. For day-to-day execution, Vanta’s 375+ integrations and workflow hooks assist pull VRM into consumption and supply. Procurement and ticketing workflows can combine with methods like ServiceNow, Freshservice, Azure DevOps, and Asana, so critiques begin early, not after a contract is signed.

Proof reuse issues if you end up onboarding the identical distributors as everybody else. Vanta Change centralizes proof requests and reuse, together with one-click pulls of public documentation from Vanta Belief Facilities and workflows to request entry to non-public paperwork. Indexing of third-party belief facilities, together with non-Vanta, is rolling out to cut back back-and-forth.

For audit and reporting, Vanta supplies government views and program reporting that roll up vendor standing, findings, and residual danger. Auditors can be given entry by means of an in-product portal, decreasing exports and one-off proof packs.

Proof level: BetaNews reviews groups reduce vendor overview time by as much as 90 p.c utilizing Vanta’s third-party danger tooling. As with every “as much as” quantity, outcomes differ by vendor combine and workflow maturity.

Tradeoffs to think about: In case your program requires deep sanctions, ethics, fame screening, or bank-grade vendor monetary evaluation at international scale, groups generally complement Vanta with specialised knowledge feeds. Additionally it is value validating present monitoring protection towards your particular vendor set throughout scoping.

Pricing: VRM is offered standalone or as an add-on to broader Vanta packages. Particulars dwell on Vanta’s pricing web page.

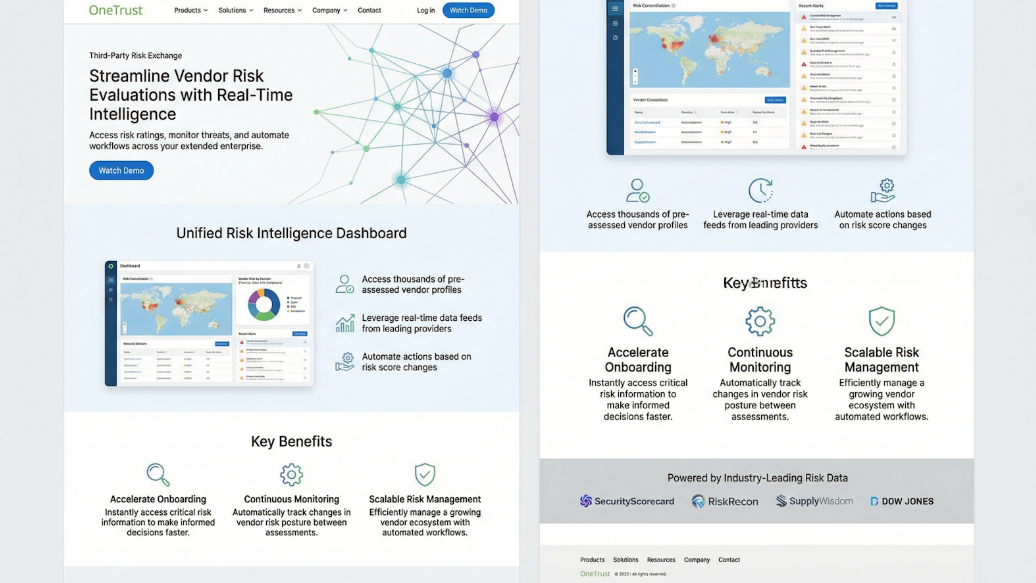

2. OneTrust: enterprise management for complicated fintech packages

OneTrust is constructed for fintechs which have outgrown level options. In case your third-party program spans hundreds of distributors and a number of areas, OneTrust brings privateness, safety, and third-party danger right into a single working mannequin.

OneTrust is right for:

- International fintechs and enormous funds firms with 1,000+ distributors and mature danger operations

- Organizations that want privateness and third-party danger to run collectively, not as separate workflows

- Groups that want executive-ready reporting throughout enterprise models, geographies, and significant vendor tiers

At a core stage, OneTrust helps the complete third-party danger lifecycle: vendor stock, inherent danger triage, assessments, findings, and remediation monitoring. The worth is much less about “sending questionnaires sooner” and extra about working one constant playbook throughout authorized, compliance, and safety.

For regulatory match, the platform is designed to assist broad privateness and governance wants, alongside third-party danger mapping to main requirements and steerage. In observe, that breadth is what makes it enticing to multi-jurisdiction fintechs balancing privateness obligations with banking-style oversight expectations.

OneTrust’s Change mannequin is a significant accelerator for due diligence. Its Vendorpedia and Third-Celebration Danger Change idea facilities on reusable vendor profiles, so your group can begin with current proof and give attention to exceptions. OneTrust’s personal launch announcement positioned Vendorpedia at 6,000+ vendor profiles as of March 4, 2019. Present protection modifications over time, so it’s value validating counts to your vendor set throughout analysis.

On steady monitoring, OneTrust packages usually herald cyber posture by means of integrations and companion feeds, fairly than treating native exterior scanning because the headline functionality. As of January 2026, groups generally pair OneTrust with a rankings supplier (for instance, SecurityScorecard) or different companion knowledge to take care of ongoing cyber sign between formal assessments. The profit is flexibility. The tradeoff is that monitoring depth is dependent upon the third-party subscriptions you select to obtain and preserve.

Operationally, OneTrust suits finest when it could sit in the course of your enterprise stack. It integrates with instruments like ServiceNow, Jira, and SIEM platforms, so remediation can stream into current IT and safety workflows as an alternative of changing into one more queue to handle. For reporting, OneTrust emphasizes embedded PowerBI dashboards, which helps bigger organizations construct regulator-ready and executive-ready views with out hand-built spreadsheets.

OneTrust can be investing in AI help. It has previewed a “Danger Agent” designed to learn and summarize Change supplies. Availability and scope are evolving, so verify what is usually out there versus preview throughout scoping.

Strengths for fintech: OneTrust is strongest once you want breadth, governance, and reporting throughout privateness and third-party danger, particularly in international, regulator-facing environments.

Limitations and tradeoffs: Implementation can take months and ongoing administration tends to be heavier than light-weight instruments. Steady monitoring is commonly integration-led, which may improve instrument and vendor-management overhead in comparison with platforms that bundle first-party monitoring indicators.

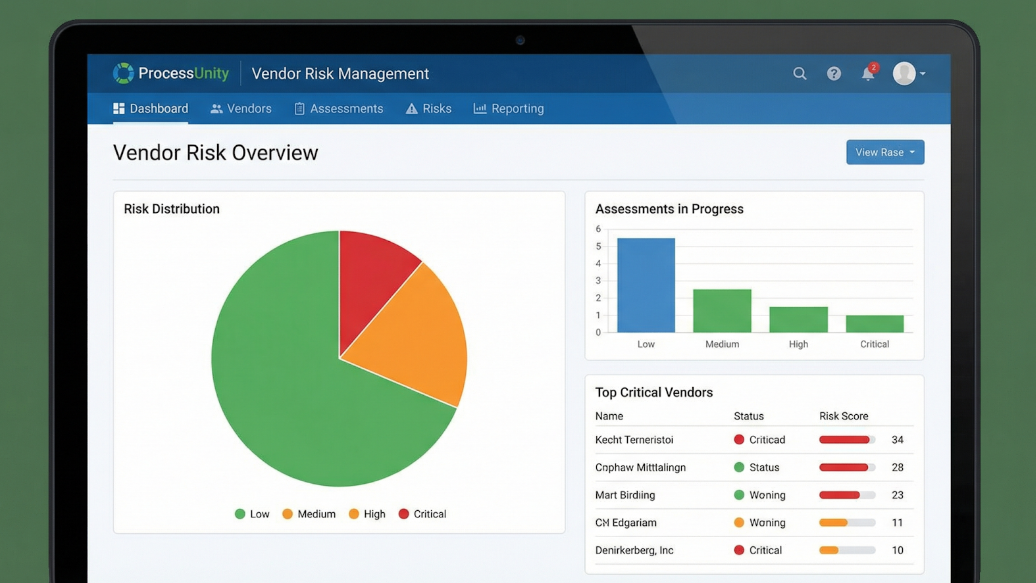

3. ProcessUnity: bank-grade workflows with out the bloat

ProcessUnity is a third-party danger platform constructed with monetary establishments in thoughts. It focuses on the components of vendor danger that present up in actual exams: constant inherent and residual danger scoring, clear accountability, and documentation that holds up underneath scrutiny.

ProcessUnity is right for:

- Fintechs that want examiner-friendly workflows and reporting, not simply questionnaire automation

- Packages with high-risk distributors the place approvals, SLAs, and follow-ups should be tightly managed

- Groups that wish to mix inner governance with exterior cyber indicators from rankings suppliers

ProcessUnity’s energy is workflow depth. If you classify a brand new cost processor as excessive danger, you’ll be able to route a tailor-made evaluation, assign reviewers, set remediation deadlines, and monitor completion throughout each step of the lifecycle. That construction is what retains critiques from stalling when product groups are transferring quick.

The platform additionally helps proof reuse by means of an change mannequin. ProcessUnity’s International Danger Change heritage, tied to CyberGRX, is designed to cut back repetitive due diligence by letting groups pull shared assessments and danger profiles the place out there, then give attention to exceptions.

For ongoing oversight, ProcessUnity packages generally pair structured assessments with steady indicators. Your group can enrich vendor data with cyber rankings knowledge from suppliers comparable to BitSight, providing you with a gradual stream of telemetry to enrich document-based proof. That is particularly helpful when you’ll want to monitor massive portfolios with out re-running full assessments each time a vendor modifications its stack.

On the regulatory facet, ProcessUnity is positioned round financial-services expectations, together with FFIEC-style oversight, and it additionally publishes DORA enablement content material for EU resilience packages. In observe, which means the instrument is a match when your stakeholders need danger scoring and reporting to map cleanly to what regulators ask to see.

Implementation and time-to-value rely on how a lot you configure upfront. Most fintechs go dwell in underneath 4 weeks with guided onboarding, and that velocity is usually helped by out-of-the-box templates and structured workflows. As with every workflow-heavy platform, the tradeoff is that deeper governance usually requires extra setup and ongoing administration than light-weight instruments.

Backside line: In case your precedence is a rigorous, exam-ready third-party danger program with robust workflow controls, change leverage, and room to combine steady cyber rankings, ProcessUnity is constructed for that job.

4. Miratech Prevalent: shared intelligence with steady scanning

Miratech Prevalent is constructed for one easy actuality: your group isn’t the one one assessing AWS, Stripe, Plaid, or the following fast-moving fintech vendor. Its mannequin facilities on proof reuse by means of an change, paired with steady monitoring that helps you react shortly when a vendor’s danger posture modifications.

Prevalent is right for:

- Danger groups onboarding a number of frequent distributors and uninterested in beginning each overview from scratch

- Packages that need exchange-based due diligence plus steady exterior monitoring in a single place

- Lean fintechs that want clear remediation workflows and government reporting with out constructing every part manually

Prevalent’s Change strategy is designed to chop down on vendor fatigue. The platform’s Third-Celebration Danger Change hosts greater than 3,000 pre-completed assessments, and the Change Community is positioned round reusable danger profiles on hundreds of distributors. In observe, this helps you start with an current packet and spend your time on gaps and exceptions, not boilerplate.

The place Prevalent goes past “paperwork velocity” is ongoing monitoring. Its Vendor Risk Monitor runs repeatedly, scanning exterior sources for indicators tied to your distributors, together with breach chatter, leaked credentials, and newly disclosed vulnerabilities. Skilled supplies additionally describe protection that extends past purely technical indicators into broader enterprise and monetary monitoring indicators. That mix issues for fintechs, as a result of vendor danger isn’t solely about CVEs. Additionally it is about whether or not a supplier can preserve working.

The workflow is simple: every vendor report rolls up inherent danger, evaluation outcomes, monitoring indicators, and open duties, so your group can see what modified and what wants motion in a single view. When a zero-day hits, the objective is to shortly reply two questions: which distributors are uncovered, and what does our contract require us to do subsequent?

Prevalent additionally helps documenting fourth-party context by means of its evaluation and monitoring knowledge, which helps when auditors ask the way you account for sub-processors and downstream dependencies.

Tradeoffs to think about: Prevalent isn’t a light-weight “plug it in and overlook it” instrument. Implementations are sometimes longer than starter platforms, particularly if you wish to absolutely operationalize each the change workflow and steady monitoring. Additionally, like all external-signal strategy, monitoring works finest when you’ll be able to corroborate points with first-party proof and drive clear remediation, in any other case groups danger chasing noise as an alternative of closing gaps.

In case your precedence is decreasing repetitive due diligence whereas preserving a continuing look ahead to vendor incidents, Prevalent is a powerful match.

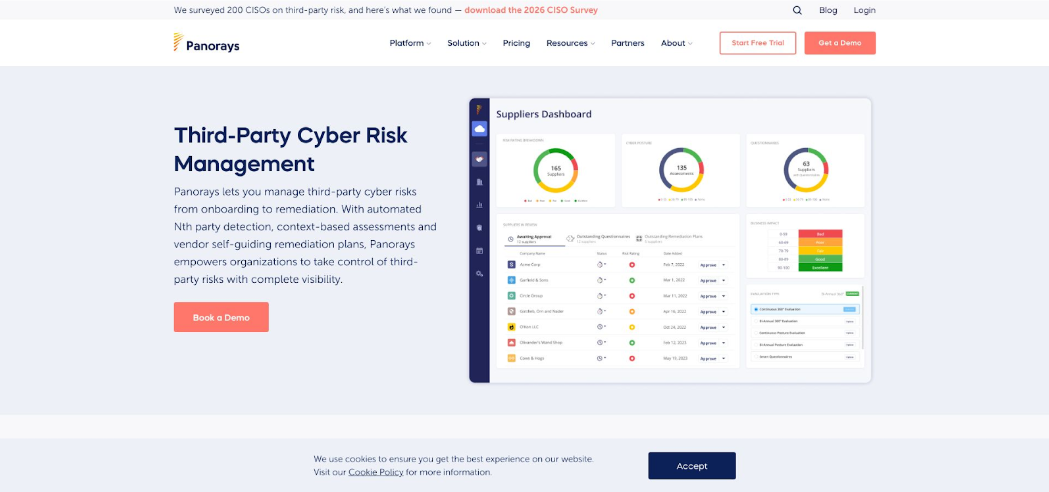

5. Panorays: exterior assault floor meets inner proof

Panorays is constructed for groups that need a quick, defensible view of vendor cyber posture with out counting on questionnaires alone. Its mannequin combines two inputs: outside-in visibility right into a vendor’s public footprint, plus inside-out proof assortment by means of questionnaires aligned to your necessities.

Panorays is right for:

- Fintechs with massive companion ecosystems that want fast prioritization throughout lots of of distributors

- Groups that need exterior posture indicators and inner proof in a single vendor report

- Packages that want a clear method to focus effort on the riskiest suppliers, not the loudest alerts

Panorays begins with exterior scanning of a vendor’s public-facing floor, searching for indicators comparable to open ports, uncovered databases, and leaked credentials. These indicators grow to be a cyber rating you should use to triage your portfolio. It then pairs that outdoors view with questionnaires you’ll be able to align to fintech staples comparable to PCI and PSD2, so your group isn’t making choices on scans alone.

The actual worth reveals up in correlation. When a scan flags a possible publicity and the seller’s responses present weak controls in the identical space, the danger ranking can bounce. That helps you give attention to distributors with actual gaps, not background noise.

For ongoing oversight, Panorays emphasizes steady visibility. The platform highlights hourly rescans, which is beneficial when vendor posture can change sooner than your overview cycles. Alerts and notifications can stream into instruments like Slack, preserving the group nearer to the sign.

Panorays can be positioned for fourth-party consciousness. A ClearBank case examine cites improved visibility and prioritization at scale, and references protection as much as fourth and even n-th events. The sensible takeaway is that the platform is designed that can assist you perceive provider dependencies, however you need to verify how deep that mapping goes to your particular vendor set throughout analysis.

Tradeoffs to think about: Panorays isn’t an exchange-driven instrument, and exterior posture indicators nonetheless want corroboration with first-party proof to keep away from false positives. Many fintechs additionally pair it with a separate GRC or inner controls platform if they need a single system for each inner compliance automation and third-party oversight.

Should you want quick vendor prioritization backed by a mix of exterior scanning and inner proof, Panorays is a powerful match.

6. Venminder: vendor danger as a service for fintech newcomers

Venminder is a powerful match when software program alone is not going to shut the hole. In case your group is lean and exams nonetheless anticipate bank-grade due diligence, Venminder pairs a VRM platform with an analyst bench that may do the heavy overview give you the results you want.

Venminder is right for:

- Seed-to-mid-stage fintechs constructing a proper VRM program with out hiring a full TPRM group

- Danger and compliance leaders who need examiner-ready write-ups, not only a doc repository

- Groups that need assistance reviewing lengthy SOC reviews and translating findings into clear motion gadgets

On the platform facet, Venminder covers the seller lifecycle: onboarding, assessments, monitoring, and offboarding, with dashboards that monitor standing, renewals, and residual danger. The place it differentiates is the service layer. When a crucial vendor sends a 100-page SOC 2, Venminder’s analysts can overview it, fee the findings, and ship a concise report again into your program workflow. That turns “we’ve the paperwork” into “we’ve a defensible conclusion.”

Venminder additionally presents steady monitoring by means of its Venmonitor modules, positioned to cowl cybersecurity, enterprise, and monetary domains. For fintech groups, that issues as a result of a vendor concern isn’t at all times a breach. It may be an operational change that impacts availability, resilience, or contractual obligations. Precise monitoring sources differ, so it’s value confirming what indicators you get out of the field.

For regulatory alignment, Venminder is oriented towards financial-services expectations, with templates and deliverables designed round FFIEC and OCC-style oversight. Skilled notes additionally reference assist for aligning assessments to requirements and frameworks comparable to ISO, NIST, HIPAA, and GDPR when related to your program.

Proof reuse is offered by means of an Change mannequin, the place you’ll be able to order or entry accomplished assessments as an alternative of restarting due diligence from scratch. Mixed with managed critiques, that may meaningfully scale back vendor chasing.

Pricing and working mannequin: Venminder usually combines a software program subscription with elective, à la carte managed assessments. That provides you flexibility to outsource solely the high-effort critiques whereas preserving easier distributors in-house.

Tradeoffs to think about: A service-centric strategy can add recurring evaluation prices as your vendor depend grows. Groups additionally usually pair Venminder with a separate inner GRC or compliance automation platform if they need the identical instrument to run inner controls. Lastly, when you’ve got strict knowledge residency wants, verify internet hosting and document-handling expectations throughout procurement.

Proof factors: Venminder states that roughly 900 organizations belief its platform and that its analysts full round 30,000 vendor danger assessments yearly. These figures can change 12 months to 12 months, so validate the newest numbers throughout analysis.

How to decide on the fitting VRM instrument

Begin with the result you can’t compromise on.

If examination readiness is the precedence, optimize for governance. Instruments like ProcessUnity and OneTrust are constructed to reflect regulator expectations, with deeper workflows and reporting that map cleanly to how examiners ask questions.

If velocity is the constraint, optimize for automation. Vanta is designed to shorten the time between “new vendor request” and “danger determination,” by decreasing handbook proof gathering and overview work.

From there, pressure-test your shortlist with just a few laborious questions:

- What number of distributors do you handle, and the way many individuals run this system? A two-person group supporting 400 suppliers wants automated proof assortment and pre-scoring to remain targeted on exceptions, not inbox chasing.

- What monitoring sign do you really want? Some packages need exterior breach and publicity intelligence. Others want controls-based proof that stays present between critiques. Decide the mannequin that matches the way you anticipate to detect points, then verify how alerts stream into remediation.

- The place will the work dwell? If engineering lives in Slack and Jira, prioritize instruments that push danger indicators and remediation duties into these methods. In case your group runs on ServiceNow and SIEM workflows, select a platform that matches that heart of gravity.

- Do you want proof reuse at scale? Exchanges and belief facilities can get rid of repetitive “ship me your SOC 2” loops. If vendor fatigue is already an issue, deal with reuse as a requirement, not a nice-to-have.

- What’s your actual price of possession? License charges matter, however so does time-to-value. A less expensive instrument that takes six months to deploy can price extra in danger publicity and misplaced time than a pricier platform you’ll be able to operationalize subsequent quarter.

- How a lot knowledgeable assist do you want? In case you are gentle on in-house reviewers, Venminder’s analyst reviews or Prevalent’s managed assessments can act as pressure multipliers. You probably have a mature TPRM group, self-service platforms usually give extra management with decrease ongoing service prices.

Make these choices upfront, then run demos towards your precise workflow: one high-risk vendor onboarding, one incident-driven reassessment, and one audit proof request. The suitable match turns into apparent when the instrument handles actual work, not a sophisticated slide deck.

Frequent vendor-risk errors fintechs nonetheless make

Treating assessments as annual chores. Danger doesn’t comply with the calendar. A vendor can introduce a crucial vulnerability the day after you shut out a questionnaire. With out steady monitoring, you study concerning the concern when prospects do.

Ignoring the fourth occasion. Your cost processor’s cloud host turns into your danger too. For each crucial vendor, doc their sub-vendors and dependencies. In any other case you miss the one level of failure hiding two layers deep.

Complicated safety with compliance. A companion’s stack will be effectively secured and nonetheless put you out of bounds on PSD2 or GLBA. Map findings to the precise requirement you need to fulfill. That’s how obscure considerations flip into clear remediation duties.

Conserving the board at midnight. Executives don’t want packet captures. They want a warmth map and a pattern line. Common, digestible reporting turns vendor danger from technical noise right into a metric the corporate can handle.

FAQs: fast solutions for busy danger groups

Do we actually want a VRM instrument, or can spreadsheets work for now? Spreadsheets monitor rows, not danger. Regulators anticipate proof of steady oversight, and prospects assume you catch vendor points earlier than they go public. A devoted VRM platform automates reminders, shops immutable audit trails, and surfaces dwell alerts. These are capabilities Excel can’t ship.

How do these instruments join with our current stack? Most distributors present connectors for cloud accounts, ticketing methods, and chat apps, so work occurs the place your group already operates. Safety findings can floor in Slack, remediation duties can land in Jira, and government reporting can plug into your BI workflows. Integration isn’t a luxurious, it determines whether or not danger indicators grow to be motion or die in one other inbox.

What about main cloud suppliers like AWS and GCP, aren’t they already compliant? Sure and no. They preserve certifications, however you stay answerable for the way you configure and monitor their companies. Main VRM platforms enable you centralize the newest SOC 2 and ISO reviews from these suppliers, then layer on monitoring indicators to flag newly rising points. You get each the paperwork and the day-to-day sign in a single place.

Conclusion

Regulators are turning vendor danger from a finest observe into a tough requirement. The 2023 U.S. interagency steerage makes banks—and by extension their fintech companions—absolutely accountable for third-party failures. Throughout the Atlantic, the EU’s Digital Operational Resilience Act (DORA) applies from January 17, 2025, and calls for a central register of all ICT suppliers, full with exit plans and testing proof.

The route is evident: oversight should be steady, documented, and visual on the board stage. VRM platforms that may export a DORA-ready vendor register or map controls to the brand new U.S. steerage transfer from “good to have” to “non-negotiable.”

Expertise is shifting simply as quick. Solely 5 p.c of packages use AI for vendor danger at present, but about 66 p.c are piloting it. Count on questionnaire autofill, anomaly detection, and generative danger summaries to grow to be commonplace by 2027. Among the many instruments on this information, Vanta is the furthest alongside.

Focus danger can be rising. Regulators are more and more involved concerning the fintech sector’s reliance on a handful of cloud and funds suppliers. That makes fourth-party visibility more durable to disregard. Mapping vendor dependencies—and exhibiting the way you reply when a sub-processor turns into the weak hyperlink—is changing into commonplace examination proof. Fourth-party mapping options, now out there in OneTrust and Prevalent, will possible matter extra in future exams.

The rule ebook is getting thicker, however the software program is preserving tempo. Select a platform that tracks regulation updates for you, and tomorrow’s audit feels far much less daunting.