The bygone yr has been an fascinating one, particularly so for the age of AI that’s quick coming. We noticed AI brokers rise for the primary time and take over repetitive duties that historically required a human workforce. Nonetheless, in 2025, most AI brokers nonetheless lived inside demos, copilots, and experimental workflows. With the onset of 2026, that’s set to vary decisively, if business insights by a number of the high consultancy corporations of the world are to be believed. The developments recommend that enterprises are shifting from testing AI brokers to letting them run whole workflows, execute selections, and set off real-world actions in 2026. So, transfer over an incremental improve, and prepare for a structural reset – as 2026 is the yr AI brokers cease being spectacular and begin being accountable.

On this article, I try to cowl all these developments that may form the close to future of labor as we all know it. Whatever the business you’re in, in case you don’t want to be omitted of this monumental shift, you’d higher undergo it and put together your self in time. So with none delay, let’s dive proper into the brand new developments of AI brokers for the yr 2026.

Class 1: How AI Brokers Work (Structure & Capabilities)

Earlier than AI brokers could be trusted, we should perceive how they’re evolving. This part solutions: “What has basically modified in agent design?”, giving us insights into what AI brokers are technically able to in 2026.

1. AI Brokers Transfer From Duties to Full Workflow Orchestration

AI brokers are not restricted to automating remoted duties. In 2026, they take possession of whole workflows. Which mainly implies that as an alternative of serving to people execute steps, brokers will now plan sequences, name up instruments, handle dependencies, and – anticipate it – even adapt when issues break. As a human, you’ll simply need to outline the aim, whereas AI brokers will deal with the execution.

This marks a shift from step-based automation to outcome-driven programs. As famous in latest analysis by Gartner, enterprises are shifting past single-agent instruments towards orchestrated, multi-stage agentic workflows. In yet one more report, PwC mentions the correct approach to go about it –

“After you establish the correct high-value workflow, intention for wholesale transformation. As a substitute of slicing a couple of steps, rethink the workflow, which an AI-first strategy could flip right into a single step. That always begins by asking not how AI can match right into a workflow however the way it can create a brand new one.”

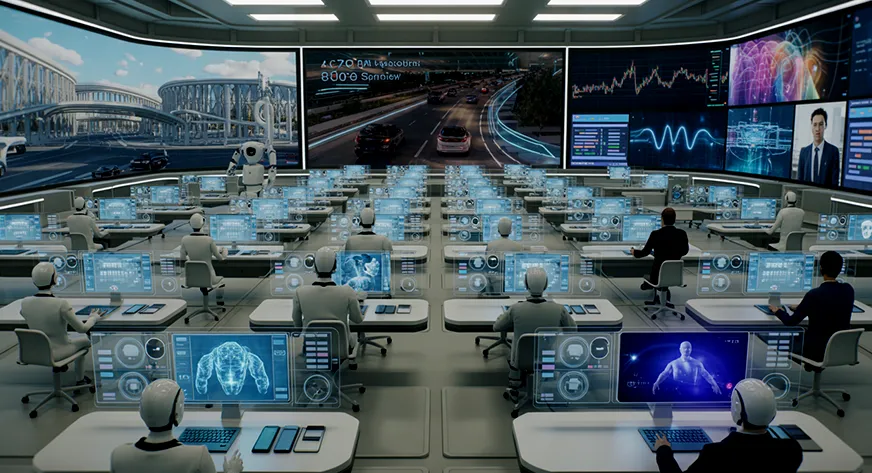

2. Multi-Agent Techniques Turn out to be the Default Structure

As AI brokers tackle bigger duties, a single agent will not be sufficient. In 2026, most real-world deployments depend on a number of specialised brokers working collectively, every dealing with a selected function inside a bigger workflow. In follow, this seems to be one thing like this –

“One agent plans, one other executes, a 3rd validates, whereas others monitor context or safety.”

The intelligence not sits in a single mannequin however is present in coordination. This architectural shift solves a tough limitation of single brokers: they wrestle with lengthy, multi-step processes. Gartner highlights a pointy rise in enterprise adoption of multi-agent programs exactly because of this, noting that modular agent groups are way more dependable and scalable. Analysis from Andreessen Horowitz (through their Massive Concepts 2026 report) additionally underscores the significance of coordinated agent programs as the inspiration for dependable end-to-end automation.

3. Workers Turn out to be AI Orchestrators

As AI brokers take over execution, human roles shift in a elementary method. In 2026, staff are not valued for finishing duties finish to finish, however for steering, supervising, and even refining the work achieved by brokers. The core human ability turns into intent-setting, with clearly outlined targets and constraints. So who handles the operational heavy lifting? You guessed it – AI brokers.

This marks a transfer away from “doing the work” towards orchestrating programs of labor. The Gartner report additionally factors to new roles centred on agent supervision and governance. Even business-focused research, akin to these from PwC, spotlight that organisations extracting actual worth from AI are forming new roles round oversight and judgment. In brief, in 2026, assume extra as a conductor of workflows than an everyday worker.

4. Agent Orchestration Platforms (Agent OS) Emerge

As organisations deploy a number of brokers throughout groups and capabilities, managing them manually turns into unimaginable. In 2026, this offers rise to agent orchestration platforms. These are sometimes described as an Agent OS. These layers don’t carry out work themselves. As a substitute, they coordinate brokers, implement insurance policies, handle permissions, observe outcomes, and deal with failures.

With out this management platform, agent ecosystems will stay brittle and unsafe. This is the reason Gartner frames orchestration and observability as stipulations for enterprise-scale multi-agent programs. From a enterprise lens, PwC additionally emphasises unified orchestration to interchange segregated AI use throughout an organisation.

5. Area-Particular Brokers Outperform Common Brokers

Common-purpose AI brokers are spectacular, however they wrestle with in depth duties. In 2026, enterprises more and more favour domain-specific brokers, which suggests brokers skilled and grounded in extremely technical and particular fields like finance, healthcare, authorized, or provide chain operations. These brokers perceive business guidelines, terminology, and constraints much better than generic fashions.

The reason being easy: accuracy and compliance matter greater than versatility in a selected organisational workflow. Gartner highlights a rising shift towards domain-specific fashions to cut back errors and enhance reliability. Enterprise leaders additionally share this view, noting that specialised brokers ship sooner ROI with fewer dangers.

In follow, the way forward for brokers isn’t one super-agent however many specialists working collectively.

Class 2: How AI Brokers Combine Into Enterprises

As soon as AI brokers develop into succesful sufficient, the actual problem begins: integrating them into on a regular basis work with out breaking individuals, processes, or programs. Right here is how we are able to envision this happening in 2026.

6. Grounding and Context Plumbing Turn out to be Obligatory

As AI brokers tackle actual duties, one weak point turns into unimaginable to disregard: brokers are solely nearly as good because the context they function in. In 2026, enterprises make investments closely in grounding brokers to verified and real-time enterprise information. This context could also be sourced from CRMs, ERPs, coverage paperwork, logs, and inside data bases.

With out this grounding, brokers hallucinate and might presumably compound errors at scale. This is the reason Google Cloud, in its report, persistently stresses enterprise grounding as a prerequisite for production-grade brokers. Even risk-focused evaluation from Forrester warns that ungrounded brokers can flip small inaccuracies into systemic failures.

7. Agent Interoperability Turns into Non-Negotiable

As enterprises deploy a number of brokers throughout instruments, groups, and distributors, isolation shortly turns into a bottleneck. In 2026, AI brokers should talk and collaborate with each other handy off duties, even when they’re constructed on completely different platforms. Closed brokers working in solitude merely gained’t scale.

This is the reason interoperability strikes from a “good to have” to a core requirement. Gartner factors to a speedy rise in multi-agent programs designed explicitly for cross-platform coordination in 2026.

8. AI Brokers Prolong Past Software program Into the Bodily World

Assume AI brokers are confined to digital workflows? Assume once more! In 2026, you’ll more and more see AI brokers function within the bodily realm – powering robots, drones, autonomous autos, warehouse programs, and good infrastructure. They may work as coordinated fleets of bodily brokers that sense, determine, and act collectively.

Gartner highlights this as a defining enterprise development, making this shift vital. It is because bodily brokers should collaborate in actual time and adapt to altering environments, all whereas working below strict security constraints.

9. Brokers Start Executing Commerce and Funds

With automation comes accountability! As AI brokers develop extra autonomous, their duties cross a vital line: financial transactions. In 2026, AI brokers type a vital a part of purchases and on-line purchasing experiences. They not simply advocate however perform end-to-end transactions.

This basically modifications digital commerce. As a substitute of people continually checking costs or availability, brokers act on intent and timing. Analysis from Google Cloud highlights rising cost frameworks designed particularly for agent-initiated transactions. In fact, for such an automation to exist, authority, verification, and accountability should be constructed into the system.

10. Safety Shifts From Alerts to Agentic Response

With AI brokers taking up extra accountability, safety must be proactive. In 2026, safety programs transfer past elevating alerts and ready for human motion. As a substitute, AI brokers actively examine threats, correlate alerts, and reply in actual time. The concept is to do all this earlier than any injury is completed.

This modifications the function of safety groups solely. Reasonably than drowning in alerts, people give attention to technique and oversight, whereas brokers deal with detection and remediation. Insights from Forrester recommend that alert fatigue is now an even bigger danger than missed assaults, pushing enterprises towards autonomous response programs.

Class 3: How AI Brokers Are Ruled, Secured, and Measured

When AI brokers begin executing selections, shifting cash, and appearing autonomously, an alarming query is raised: What occurs when one thing goes unsuitable?

11. Rogue Brokers Turn out to be a New Menace Class

As organisations deploy extra autonomous brokers, a brand new danger emerges: rogue brokers. These aren’t malicious in intent, however nonetheless can have a harmful influence. Misconfigured permissions, incomplete context, or unchecked autonomy could cause brokers to take actions they had been by no means meant to.

Not like conventional software program failures, agent errors compound shortly. One unsuitable choice can cascade throughout programs, transactions, or workflows. Evaluation from Forrester warns that no less than one main enterprise breach will stem from agent misuse or failure, not exterior hacking.

12. AI Safety Platforms Are Constructed Particularly for Brokers

Conventional safety instruments had been by no means designed for programs that may assume, determine, and act. In 2026, that hole turns into unimaginable to disregard. Because of this, enterprises undertake AI safety platforms constructed particularly to observe and management agent behaviour. These platforms observe what brokers do, what information they entry, and whether or not their actions keep inside authorized boundaries.

These programs additionally detect dangerous prompts, unauthorised selections, and irregular agent exercise earlier than injury happens. Trade evaluation from Gartner factors to the rise of such AI-native safety layers as a direct response to agent autonomy.

13. Governance Shifts From Ethics to Survival

In 2026, organisations will realise that moral AI conversations aren’t sufficient. They now want governance frameworks that handle dangers and implement accountability in actual time.

Brokers act on information, make selections, and contact vital enterprise processes. A misstep can lead not simply to a foul suggestion, however to monetary loss, compliance breaches, or operational failure. This sharp actuality is mirrored in analysis from PwC, which argues that accountable AI isn’t about idea anymore however about embedding governance into workflows earlier than failure hits.

14. ROI Strain Kills Experimental Brokers

By 2026, the honeymoon interval for AI experimentation is over. Enterprises are not impressed by demos, pilots, or intelligent proofs of idea. Each AI agent is predicted to justify its existence with a measurable enterprise influence. This could be a value saved, time lowered, or income generated.

This shift is pushed by rising scrutiny on the management stage. Enterprise-focused analysis from PwC highlights that AI investments are more and more judged on outcomes, not capabilities. Brokers that may’t reveal clear ROI are paused, scaled again, or shut down solely.

15. The Rise of the AI Generalist Workforce

As AI brokers take over execution-heavy and mid-tier duties, the talents that matter most start to vary. In 2026, organisations place higher worth on AI generalists. These are individuals who perceive the enterprise end-to-end and might supervise, information, and consider agent-driven work throughout capabilities.

As a substitute of deep however slim specialisation, corporations search for people who can join context, judgment, and outcomes. The McKinsey/World Financial Discussion board evaluation reveals how people, brokers, and robots will work collectively in hybrid roles centered on planning, oversight, and judgment, not simply slim specialisation.

Conclusion

The clear understanding for 2026 when it comes to AI brokers and related developments is that this: such brokers are not an rising concept however an operational actuality. This shift is then more and more about rebuilding how work will get achieved. Brokers will orchestrate workflows, transfer cash, safe programs, and even act within the bodily world.

The winners gained’t be those that experiment probably the most however those that combine, oversee, and measure brokers decisively. The one query then stays is whether or not your organisation is able to work with them or be outpaced by those that are.

Login to proceed studying and luxuriate in expert-curated content material.